If you need to do anything in India about the Goods and Services Tax (GST), the GST Portal is the place to go. If you’re a business owner, a tax professional, or a regular taxpayer, the GST portal login lets you handle everything, from registering for GST to making payments, filing reports, and making sure you’re following the rules. The GST site can be challenging to find your way around at first, but once you know how to join in and what the site can do, you can easily handle your GST activities.

This blog will discuss how to access the GST login portal and the various services available on the Goods and Service Tax portal. Aside from that, we’ll also talk about GST Login India and how to use the tools on www.gst.gov.in.

What is the GST Portal?

The GST portal is the official place for all things GST-related. It has tools as well as information for taxpayers to register, file returns, make payments, and check the status of their GST transactions. You can get to this site at www.gst.gov.in. It is the primary method by which the government talks to taxpayers. The GST portal has several key features, including:

- GST registration for businesses and individuals.

- Filing GST returns.

- Payment of GST dues.

- Accessing and downloading GST certificates.

- Verifying GST details for registered entities.

How to Access the GST Portal Login?

You must adhere to a few simple processes to gain access to the GST portal. To access your account, follow these steps:

Step 1: Visit the Official GST Website

First, open your web browser and go to www.gst.gov.in to access the official GST portal. This official page manages all matters related to GST services login.

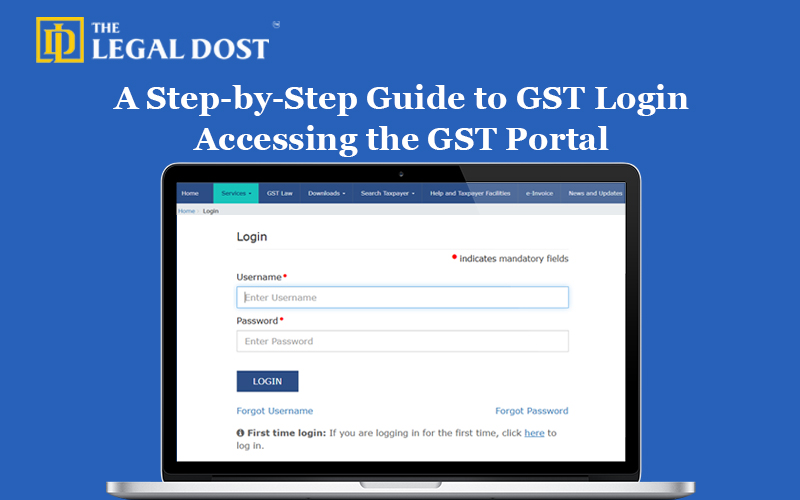

Step 2: Locate the Login Button

Locate the GST portal login button in the upper right corner of the gst.gov.in homepage. You can access your GST account by clicking this button.

Step 3: Enter Your Login Credentials

You need to have your GST credentials in order to access the system.

- Username: This is the username that was used at registration, or it might be the GSTIN (Goods and Services Tax Identification Number).

- Password: The password that you generated during the registration process.

To proceed, select the Login button after entering your GST login credentials.

Step 4: Complete the CAPTCHA

Before proceeding, it is necessary to correctly complete a CAPTCHA challenge for security reasons. Enter the characters displayed in the CAPTCHA box to submit the form.

Step 5: Access Your Dashboard

Once you successfully log in to GST portal, your dashboard will appear, allowing you to manage all your GST-related activities. The dashboard includes tabs for returns, payments, notices, and more.

Services Available on the GST Portal

The Goods and Service Tax portal provides a wide range of services to help taxpayers in the management of their GST accounts. The GST portal online offers the following fundamental features.

GST Registration

Businesses are able to register for GST by accessing the goods and service tax login portal. The portal enables you to track the status of your application, view registration details, and obtain your GST certificate once you have registered.

GST Return Filing

The GST services login platform allows for the submission of GST returns. Taxpayers have the option to submit returns on a monthly, quarterly, or annual basis, depending on their business needs. The portal supports a variety of returns, including GSTR-1, GSTR-3B, and GSTR-9.

Payment of GST

You can make your GST payments online by logging in through the link www.gst.gov.in login. Ensuring a seamless compliance process, the portal enables you to generate challans, pay dues, and track the status of your payments.

GST Verification Portal

Businesses that need to verify the GST details of their suppliers or associates must utilize the GST verification portal. You can verify the registration status of any GSTIN by using this feature on the www.gst.gov.in URL.

Tracking and Downloading Documents

The service gst.gov.in login allows you to download essential documents, including your GST certificate, file notices, and track the status of your applications. This is especially beneficial for organizations that are required to preserve compliance records.

Taxpayer Search

Businesses can authenticate the identity of other taxpayers by entering their GSTIN number through the GST login search function. This service is accessible through the goods & service tax login section of the portal, which enables real-time verification.

Navigating Different Login Categories on GST Portal

The GST portal login in India provides a seamless interface to enable access to the system for a variety of users. The categories consist of:

- Regular Taxpayers: This category includes the majority of users who are capable of overseeing GST compliance, payments, and returns.

- Composition Taxpayers: Businesses that operate under the composition scheme are subject to a separate filing process that is accessible through the gstportal.

- Tax Practitioners: The goods and service tax are the portal through which tax professionals can access and manage their clients’ accounts, submit returns, and process payments.

Special Features on GST Portal Online

Additional features are available on the GST portal to simplify the process of complying for users. Some of these are as follows:

- E-Way Bill Generation: The portal enables taxpayers to directly generate and manage e-way bills.

- Application for Amendments: If there are modifications to the business details, taxpayers may submit an application for registration amendments via the goods & service tax login.

- GST Refunds: The portal allows you to apply for refunds for things like extra tax payments, export refunds, and more.

Security and Support on the GST Login Portal

The goods and service tax portal are heavily secured. The system uses strong security and CAPTCHA to ensure the safety of logins. The services gst.gov.in page also has solutions and frequently asked questions (FAQs) for users who need help.

The goods and service tax portal has a customer service area where people can go if they have any technical problems with service tax logins or the GST system.

Tips for Using the GST Portal Effectively

Make your GST login process easier by adhering to the following tips:

- Bookmark the Website: You can bookmark the www.gst.gov.in URL to access the site quickly.

- Keep Your Credentials Safe: Make sure you keep your GST credentials secure. If you forget your password, the GST login portal in India allows you to recover it.

- Regularly Update Information: On the goods and service tax login page, make sure that your business information is correct so that you don’t have any problems with compliance.

Summary

The GST portal login lets taxpayers handle all of their GST-related tasks from one place. You can register for GST, file returns, make payments, and check on other taxpayers using the easy-to-use and safe www.gst.gov.in login portal. If businesses follow the steps and use the tools on the goods and service tax portal, they can stay in line with GST rules and avoid penalties.

For all Indian users, the goods & service tax login is not only a way to make sure they are following the rules but also a way to make the GST process clearer and easier to handle. Don’t forget to use the GST portal login in India for simple and smooth tax management!

Understanding e-Invoices under GST in India (FAQ’s)

The official GST login website is www.gst.gov.in.

To get to your account, go to www.gst.gov.in, click on the “Login” button, enter your username and password, and then finish the CAPTCHA.

You may download your GST certificate, check your registration status, file GST returns, pay taxes, and confirm your GSTIN.

On the GST login page, click the “Forgot Password” link and then follow the on-screen steps to make a new one.

Yes, you can use the GST verification portal at www.gst.gov.in to check a GST number.

Yes, you can file GST returns every month, every three months, or every year after logging in.

Once you’re in the GST site, go to User Services and click on “View/Download Certificates.”

Clear the browser cache, try a different browser, or get help from GST customer service.