The GST regime in India has fundamentally altered the taxation of goods and services. What are the Integrated Goods and Services Tax (IGST)? It is one of the main parts of GST. To understand how GST works, you must look at its different parts, including CGST, SGST, and IGST. This blog post talks about what these terms mean, how they work in the Indian tax system, and how they affect businesses and customers.

What is GST and its types?

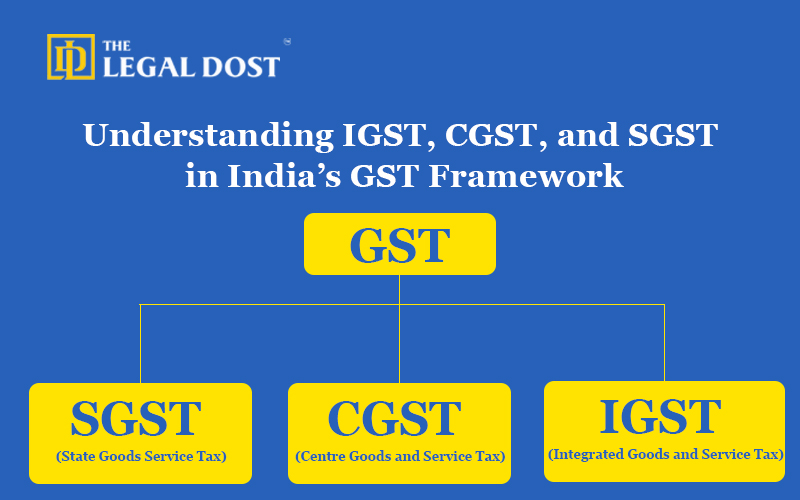

Goods and Services Tax, or GST, is a unified tax that takes the role of several indirect taxes, including service tax, VAT, and excise duty. Its design is to provide a uniform tax system across the nation, increase compliance, and simplify tax procedures. The following are the types of GST in India:

- CGST: The Central Government levies the CGST (Central Goods and Services Tax) on intra-state transactions.

- SGST: The State Governments levy the SGST (State Goods and Services Tax) on intrastate transactions.

- IGST: The Central Government levies the IGST (Integrated Goods and Services Tax) on interstate transactions and imports.

- UTGST: Union Territories levy the UTGST (Union Territory Goods and Services Tax), which is similar to the SGST and applies in Union Territories like Chandigarh and Lakshadweep.

These taxes work together to ensure that the Centre and the States share revenue without subjecting the taxpayer to multiple taxes.

What is IGST and its applicability?

Under the GST framework, the Integrated Goods and Services Tax, or IGST, is a key component in controlling interstate trade. The central government imposes IGST as a tax on goods and services transported between states. It applies to imports and exports as well.

The IGST meaning becomes clearer when we take into account that it guarantees smooth cross-border flow of goods without requiring separate state taxes. Applying solely IGST to these transactions rather than both CGST and SGST makes the procedure more effective and business friendly. IGST is applicable in two primary scenarios:

- Inter-State Transactions: When a transaction occurs between two states, like Maharashtra and Gujarat, the Central Government levies IGST. This tax is collected by the central government, which then divides the proceeds between the states where the goods or services are consumed and where they are produced.

- Imports and Exports: India imposes IGST on imported goods and services to make sure they receive the same treatment as domestically produced items.

IGST eliminates the requirement to impose CGST and SGST separately in both of these situations.

What is CGST and its applicability?

The Central Government imposes the CGST (Central Goods and Services Tax) on intrastate transactions, or the provision of goods and services within the same state. This suggests that when a company sells goods or renders services inside state lines, it is subject to both the CGST and the SGST (State Goods and Services Tax).

The CGST full form itself makes clear that its goal is to guarantee that local transactions generate revenue for the Central Government. In order to prevent discrepancies between state-level tax systems, one of the main goals of the CGST is to establish a consistent tax structure nationwide. Additionally, it keeps things transparent and makes doing business easier.

CGST Applicability

CGST is applicable in state-wide deals where CGST and SGST are charged simultaneously. The Central Government and the State Governments split the collected tax. This is how CGST works in different situations:

- Intra-State Transactions: Both CGST as well as SGST apply to goods and services provided within a state, such as within the borders of Karnataka. This makes sure that the State Government gets the SGST, and the Central Government gets its share of the taxes.

- Revenue Sharing: The CGST tax goes to the Central Government, which then uses the funds to pay for national projects, infrastructure, and public welfare programs.

The CGST streamlines the taxation system, making it simpler for businesses to file their taxes under a single system without encountering issues from outdated tax regimes like excise duty or service tax.

What is SGST and its applicability?

At the state level, SGST, or State Goods and Services Tax, is the same thing as CGST. It is required by the State Government for all activities that take place in a certain state. When a deal takes place within the state’s borders, the government charges the same amount of CGST and SGST. The SGST revenue comes from the state where the deal takes place, and the CGST revenue goes to the Central Government.

The SGST full form clearly defines it as a tax that the State Government collects from state-level activities to fund services, infrastructure, and government. Just like CGST, SGST is applicable for intrastate transactions. Here’s how it functions:

- Intra-State Transactions: SGST is added to CGST when goods or services are provided within a state. For example, a business in Tamil Nadu selling items would be subject to SGST. The calculation of both taxes is on the basis of the deal value. In the case of a product with a total GST rate of 18%, 9% would be CGST, and 9% would be SGST.

- Revenue Allocation: The SGST tax is collected by individuals and is given to their state government. This allows the state government to fund projects at the state level, improve facilities, and offer public services.

UTGST’s full form and its applicability

In the context of Union Territories, UTGST (Union Territory Goods & Services Tax) closely relates to GST registration. Similar to the way in which the state governments impose SGST on the intra-state supply of goods and services, the handful of Union Territory governments impose UTGST.

A Union Territory imposes this tax on the provision of goods and services. The UTGST Act, 2017, subject to periodic amendments, governs and levies it alongside CGST.

Union Territories, lacking their own legislature, levy a tax known as UTGST, similar to SGST. UTGST applies to supplies made in the Andaman and Nicobar Islands, Chandigarh, Dadra & Nagar Haveli, Daman & Diu, Lakshadweep, and Ladakh Union Territories. Ensure that due to the existence of their own legislatures, Delhi, Jammu & Kashmir, and Puducherry fall under the jurisdiction of SGST law.

Benefits of the GST System

The introduction of GST and its various types, such as CGST, SGST, and IGST, has brought several benefits:

- Elimination of Cascading Taxation: Every step of the supply chain was subject to taxes before the GST, which raised the price of goods and services. GST lowers the overall tax burden by just levying it at the final stage.

- Simplification of Tax Structure: The simplification of the tax structure has made the entire tax process simpler and more efficient for businesses, as they now only need to comply with GST rather than dealing with multiple taxes, such as VAT, excise, and service tax.

- Boost to Inter-State Trade: Businesses can trade between states without having to worry about different state taxes when IGST is in place. This has improved the flow of goods and services throughout India.

- Increased Revenue for States and the Centre: Through CGST and SGST, taxes are split between the Central Government and the State Governments. This way, both get an equal amount of revenue.

Summary

The cornerstone of India’s GST system is the full form of IGST, CGST, SGST, and UTGST. For businesses to maintain compliance and for consumers to understand the taxation of the commodities and services they consume, it is essential to comprehend these components. The implementation of GST has transformed the Indian taxation system, bringing about a unified approach to indirect taxation, as well as transparency and efficacy.

Understanding the various types of GST in India, including CGST, SGST, and IGST, is essential for navigating the complexities of the tax regime, regardless of whether one is a business proprietor, taxpayer, or consumer. The GST has made substantial progress in the direction of economic integration throughout India by simplifying the tax collection process and establishing a uniform market.

In summary, the Goods and Services Tax (GST) aims to streamline the existing tax system, facilitating business operations nationwide and ensuring equitable and efficient tax collection.

Understanding IGST, CGST, and SGST in India’s GST Framework

The IGST full form refers to the Integrated Goods and Services Tax, which the GST system levies on imports, exports, as well as interstate activities.

The IGST meaning refers to the tax that the central government imposes on goods and services that are exchanged between states or across international borders.

CGST meaning refers to the Central Goods and Services Tax, which is levied on transactions that take place inside a single state and is collected by the Central Government.

GST includes three different tax types: CGST (Central), SGST (State), and IGST (Integrated) to simplify tax collection on goods and services throughout India.

SGST means the State Goods and Services Tax, which is imposed on intra-state transactions by the state government.

A consumption-based tax is put on the supply of goods and services. This makes sure that taxes are collected at the point of usage instead of the point of origin.

Both CGST and SGST are applicable for intra-state transactions. The Central Government collects CGST, while the State Government collects SGST.

Imports are subject to the same IGST charges as goods made in India. This makes sure that taxes are the same for both international and domestic supplies.