India now has a unified tax system thanks to the GST (Goods and Services Tax) system, which consolidated several indirect taxes into one. Every Indian state and union territory has its own GST state code, which facilitates simple tax filing procedures and helps in determining the place of origin of goods and services. The GST state code list is examined in full here, along with certain crucial details regarding the codes’ uses.

What is the GST State Code?

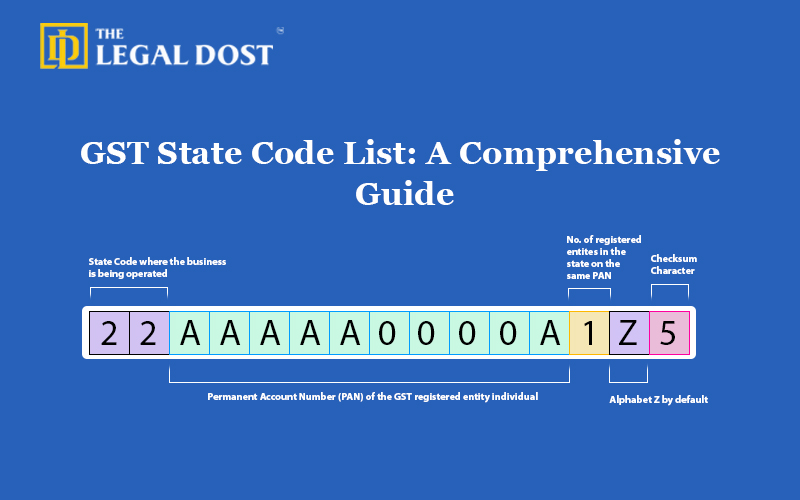

Each Indian state and union territory receives a two-digit identifier known as the GST state code in order to obtain a GSTIN (GST Identification Number). The first two digits of the GSTIN represent the state code, which helps in identifying the taxpayer’s registered state.

Accurately tracking transactions across states requires these codes. Businesses that operate in numerous regions must be aware of the specific codes for each state.

List of GST State Codes in India

You can find the list of 29 states of India and their corresponding GST state codes here. The Central Board of Indirect Taxes and Customs, or CBIC GST, assigns the codes, which are essential for tax filings.

Jammu & Kashmir | 01 |

Himachal Pradesh | 02 |

Punjab | 03 |

Chandigarh | 04 |

Uttarakhand | 05 |

Haryana | 06 (commonly known as 06 GST state code) |

Delhi | 07 (referred to as 07 GST state code) |

Rajasthan | 08 (known as 08 GST state code) |

Uttar Pradesh | 09 (also called 09 GST state code) |

Bihar | 10 |

Sikkim | 11 |

Arunachal Pradesh | 12 |

Nagaland | 13 |

Manipur | 14 |

Mizoram | 15 |

Tripura | 16 |

Meghalaya | 17 |

Assam | 18 |

West Bengal | 19 (19 GST state code) |

Jharkhand | 20 |

Odisha | 21 (21 GST state code) |

Chhattisgarh | 22 (22 GST state code) |

Madhya Pradesh | 23 (23 GST state code) |

Gujarat | 24 (24 GST state code) |

Daman & Diu | 25 |

Dadra & Nagar Haveli | 26 |

Maharashtra | 27 |

Andhra Pradesh (Before division) | 28 |

Karnataka | 29 (29 GST state code) |

Goa | 30 |

Lakshadweep | 31 |

Kerala | 32 |

Tamil Nadu | 33 (33 GST state code) |

Puducherry | 34 |

Andaman & Nicobar Islands | 35 |

Telangana | 36 (36 GST state code and 37 state code after bifurcation) |

Andhra Pradesh (After division) | 37 (37 GST state code) |

Understanding these codes is crucial for appropriate tax management for companies and individuals involved in interstate supply transactions.

Importance of Knowing GST State Codes

It is essential to comprehend and utilize the appropriate GST state codes in order to file accurate returns and prevent discrepancies. These codes help identify the correct state’s authority to receive the tax. For example:

- Delhi’s GST code is 07, which means businesses registered in Delhi will use this code in their GSTINs.

- Maharashtra utilizes the number 27, and understanding this is crucial for businesses operating in Mumbai, the financial capital, or other regions of the state.

Using the incorrect GST state code can lead to inaccurate filings as well as audit issues. Thus, it’s critical to get familiar with the state codes, particularly if you’re running a company that operates in several jurisdictions.

When and Where to Use State Code in GST

Every taxpayer under GST must be aware of the correct GST state codes for each state and union territory, as these codes are crucial for many aspects of GST compliance and adjudications. The following are the main reasons why state code GST is important:

GST invoice and e-Invoicing

When it comes to correcting GST invoicing and e-invoicing, the GST state code becomes important. The valid GSTINs of the buyer, seller, and consignee include the required state codes. In this type of transaction, we use these codes to determine the place of supply. The place of supply ultimately determines which form of GST to apply after considering whether the sale is intrastate or interstate.

GST registration

The applicant must provide correct and comprehensive information in order to receive a valid GST registration. The state and central jurisdictions of the main place of business are crucial pieces of information. The officer confirms the information the taxpayer provided. After that, the official gives the applicant a GSTIN, which contains the applicable GST state code.

GSTR-1 and GSTR-3B return reporting

Regular taxpayers are required to provide the GSTIN and other B2B invoice details in their monthly or quarterly GSTR-1/IFF filing. The buyers provide their respective GSTR-2A/GSTR-2B with these details based on the GSTIN.

The GST portal does not provide a way to confirm that a tax invoice with a particular buyer’s GSTIN has been entered correctly in GSTR-1/IFF unless the e-invoice portal fills it in automatically. Therefore, if the seller enters the incorrect GST State code in the invoice information in GSTR-1/IFF, the incorrect person or GSTIN may find tax credit in GSTR-2A/2B rather than the rightful buyer.

Classification of GST jurisdictions

Jurisdictions can include both central and state jurisdictions.

The state administration in question has assessed or is currently assessing the state jurisdictions. The Center directly administers the Central Jurisdictions.

On September 20, 2017, CGST Circular No. 21/2017 outlined a procedure for separating the Central and State authorities.

- According to the guidelines, the State administration will own 90% of taxpayers whose total revenue is less than Rs. 1.5 crore. The central government will own the remaining 10%.

- However, the center would own the remaining 50% of taxpayers, with a total turnover of more than Rs. 1.5 crore, while the state administration will own 50%.

A computer at the state level initiates the division of GST taxpayers. For this, stratified random sampling is used, accounting for the taxpayer’s location and registration type.

Therefore, the GST divides the jurisdictions into the following tiers, which are based on size and hierarchy:

- Division offices

- Range offices

- Zone

- Commissionerate’s

Summary

In order to properly identify states and union territories for tax reasons, the GST state code list is a crucial component of India’s tax system. Understanding your state code is essential for adhering to GST requirements, regardless of whether you live in Punjab, West Bengal, Tamil Nadu, or any other state. Ensure that you’re using the correct code whenever you file your returns to prevent any legal issues.

To learn more about the GST details of various states and their capitals, or to find out which state corresponds to a specific GST code, consult the comprehensive list of 29 states of India with capital. In order to effectively handle your GST filings, it is imperative that firms comprehend these codes.

GST State Code List: A Comprehensive Guide (FAQ’s)

To determine the taxpayer’s location for GST registration, each state and other territories assigns a two-digit number called a GST state code.

India consists of 29 states and capitals, and for taxation purposes, each state has its own GST state code.

The 27 code is the GST state code for Maharashtra. It assists in determining which state has jurisdiction over tax filings.

Businesses registered in Uttar Pradesh are represented by the 09 state code, which is the GST state code for the state.

The GST state code appropriately credits the state or other territory providing the goods or services with paying the taxes.

Yes, the GST system offers a comprehensive list of codes for each of the 29 states and capitals as well as union territories.

Using the wrong state code, such as confusing the 27 codes with the 09 code, can result in incorrect filings and potential penalties during audits.

No, in order to ensure correct tax identification and jurisdiction alignment, union territories and other territories have their own unique codes that are unique to those of the 29 states and capitals.